Spring Budget 2024

After 14 years of campaigning, we were pleased to hear the Chancellor state publicly that the Child Benefit Tax Charge was unfair to families particularly where one parent stays at home to care.

The fact that the principle of household taxation was publicly acknowledged means there is a public recognition that the principle can be changed to make life fairer for families.

Chair of Treasury Select Committee: Make Child Benefit Fairer & Simpler

Harriet Baldwin MP, Chair Treasury Select Committee, said on Woman’s Hour this week that her number one recommendation to the Chancellor for the Spring Budget would be to change the Child Benefit system. This is a massive turnaround and exciting for MAHM who via Miriam Cates MP and in cooperation with Tax & the Family sent briefing papers to Harriet.

Response to the Autumn Statement

Despite the reductions to tax announced in today’s Autumn Statement, total tax revenue as a share of GDP remains to reach its highest level since the 1940s. This is due to the freezing of tax thresholds and high inflation which means that many more families are being pushed into paying tax and increasingly the high rate of tax.

We need your stories!

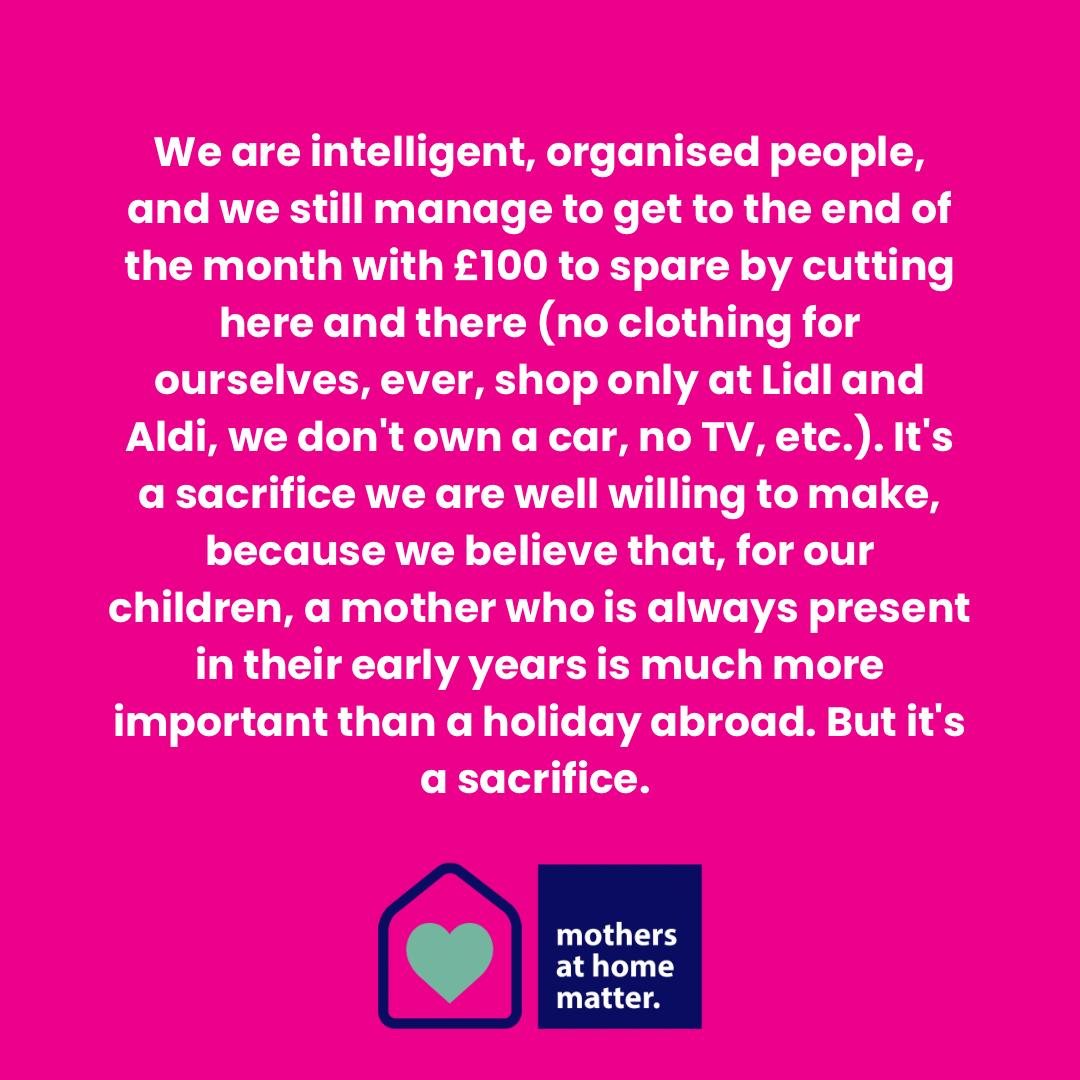

We need your stories! Struggling families who have a parent at home caring for their children also need help. A fairer tax system which recognises the household income rather than individual income with tax breaks would go a long way to supporting such families. This affects so many hard working families — please help us share your story.

National Insurance Credit Changes

Our voices have been heard! After campaigning for all mothers to be eligible for their state pension regardless of whether they sign up to the Child Benefit or not, it is finally coming to pass!

Call to Action

Had enough of being called ‘economically inactive’? It is time to find our voice and speak up for the value of care. Raising children and taking care of our elderly are not 'barriers to work’ or ‘burdens'. It is the most important work and the duty of every good society to take care of its most vulnerable members.

Spring Budget 2023

The Chancellor has listened to the cry of childcare but is he prepared for the cry of separation? Mr Hunt has put another nail in the coffin for mothers wanting to make the choice to stay home to care. This attack on our freedom is justified in the name of productivity. ‘Getting mothers into paid work will boost the economy and growth’. But it is based on the insulting myth that mothers nurturing babies and toddlers are doing nothing at home; they are ‘inactive economic units’.

Response to Miriam Cates’ post

Miriam Cates, a huge supporter of the invisible work done by mothers based at home, was slated by ‘Pregnant then Screwed’ amongst others yesterday with some of her comments taken out of context and misquoted.

House of Commons meeting

Mothers At Home Matter tackled the unfairness of the tax system today at the House of Commons with a presentation to MPs hosted by Miriam Cates MP. MPs were set five quiz points - which no one got the answers correct - the answers are quite staggering.

Make Child Benefit FAIR!

We urge you to call on your MP to attend the debate about the Higher Rate Child Benefit Charge this week. Mothers At Home Matter have written a template letter to help you raise the issue of the unfair taxation by which many families are penalised. This is an opportunity to press your MP to represent your view.

Britain’s Anti-Family Tax System

We greatly appreciate Frank Young’s article in The Spectator this week. What do you think? Does Britain have an anti-family taxation system?

News Value Mothers At Home

Mothers At Home Matter’s response to the highly publicised March of the Mummies has been published in the Daily Mail today. Let’s recognise Choice and March for all Mummies.

March of the Mummies?

Mothers At Home Matter’s response to the highly publicised March of the Mummies. Let’s recognise Choice and March for all Mummies.

Parents need Choice!

Mothers At Home Matter was asked by the Telegraph to comment on the proposals put forward by Civitas on reforming childcare. Conversations around childcare must positively include and recognise those mothers who choose, or would prefer the choice to, carry out this valuable work themselves. For ten years the Department for Education has been sitting on evidence that two-thirds of mothers would rather work a lot less and spend more time being a mum, but policy announcements and government cash all go in the opposite direction. We need to listen to mothers.

Struggling Families — letter to The Guardian

Tax & The Family and Mothers At Home Matter write to The Guardian: Jeremy Hunt, the latest Chancellor, said that the Government should be compassionate, with those who are struggling. At a time of growing in-work poverty he should consider tax changes which benefit the least well-off — in particular those in poverty with incomes of less than 60% of the median; those where one parent stays at home to look after children or care for a relative; and those with large families.

Response to The Guardian

Mothers at Home Matter welcome the news that Liz Truss and her education minister, Kit Malthouse, are exploring widening the options for childcare, freeing parents to spend on childcare as they see fit. We remind Liz Truss of her pledge to remove the penalties for parents staying at home to care for their children and implore her and Kit Malthouse that this cash should also be accessible for parents caring at home.

Let Down Again

Mothers At Home Matter and Tax & The Family are highly critical of today’s announcement by the Chancellor of the Exchequer to abolish the 45p rate and advance to the reduction to 19p in the basic rate of tax next year. He is focussing the tax reductions on those with higher incomes, while very largely ignoring those who pay income tax even though they are in poverty

Tory family values dropped

‘A single earner household family in the UK pays 85 per cent more tax than a comparable French family, twice as much as a comparable US family, and eleven times more than a comparable German family,’ writes Danny Kruger MP. Will Liz Truss make ‘a grand commitment to put families at the heart of the domestic agenda?’

Tax Reforms Needed

This past week Mothers at Home Matter joined Tax and the Family at an online event hosted by Miriam Cates MP and CARE on the Taxation of Families.

Response to Spring Statement

The Chancellor in his Spring Statement said that the number one priority in the Conservatives desire for tax reform is to reduce taxes for ‘hard-working families’. The tax system does not recognise the ‘family’, writes our Chair, Anne Fennell. All tax cuts are for ‘hardworking individuals’. Focused tax cuts should be on HOUSEHOLD incomes with children.